Will Atlantic Yards get special treatment under the 421-a tax exemption, which has provided massive tax breaks to developers building luxury condos and luxe condo buyers, but which is being tightened to require some affordable housing in return for the taxpayer subsidy and to make more neighborhoods off-limits for the subsidy? Apparently so.

The 421-a tax break is now working its way through the state legislature. Atlantic Yards Report’s Norman Oder reports that “a bonus for developer Forest City Ratner’s Atlantic Yards project appears hidden in the verbiage.”

The verbiage, as reported by The Real Estate:

The one exception, however, is laid out in Section 6, paragraph 13, which refers to “a multi-phase project” with “at least 2,500 dwelling units” that has been “approved by the Public Authorities Control Board”—which, to people who have been following the project in central Brooklyn, can mean only one thing: Atlantic Yards.

AYR reports:

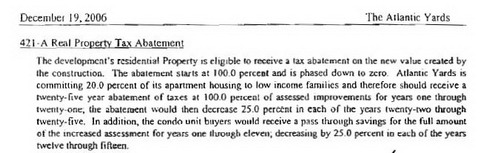

Instead of requiring the condo buildings–perhaps four of the 16 towers–at Atlantic Yards to include 20 percent affordable units, as the tax break reform would require, the developer would be allowed to spread the affordability over the project as a whole—as long as the project met some requirements that would apply only to… Atlantic Yards.

Brad Lander of the Pratt Center for Community Development, who’s reviewed the legislation and has followed the discussion swirling around the bill, thinks that’s wrong. “There shouldn’t be special side deals for particular developers. Buildings that include 20 percent affordable housing should get a tax break and all market-rate buildings should pay their taxes,” said Lander, who was part of a mayoral task force that recommended reforms last year.

Moreover, the bill would allow this project to violate the spirit of affordable housing. Affordable housing is defined as 30 percent of household income. However, the “Atlantic Yards carve-out” would allow lower-income residents of affordable apartments to be charged a higher percentage of their rent—perhaps 35 percent rather than 30 percent.

We believe the 421-a program is a tax giveaway to the wealthy that should have been killed off and that the reforms, while worthwhile, are the equivalent of rearranging deck chairs on the Titanic. That being said, it’s fascinating to see an Atlantic Yards Exception actually being written into law.